Grandomizer facilitates this educational journey by linking individuals to investment education organizations. With Grandomizer, finding resources to deepen one's understanding of investment concepts becomes straightforward. Instead of sifting through the internet for possibly bewildering information, Grandomizer simplifies this process by connecting users to educational firms.

To make registration easy, Grandomizer has streamlined its registration. The information required is minimal, and within minutes, anyone can get on Grandomizer. Want to embark on this journey? Registering with Grandomizer gives individuals access to a package that provides information to help them make decisions in the investment world.

To begin, visit the Grandomizer website to register. The process is easy; once details are entered correctly, individuals are moved closer to the investment education needed. The registration process is straightforward, asking only for basic details to ensure quick and seamless registration.

Upon registration, new users are matched with an educator that aligns with their interests. Grandomizer considers individual learning goals, investment preferences, and prior experience to make these matches.

This step ensures users are paired with institutions that align with their learning styles and investment objectives.

After registering with Grandomizer, expect contact from an educational institution's representative to introduce the learning process. Representatives are trained to provide clear, concise information about the courses, schedules, and methodologies of the educational programs.

The representative will be available to answer any questions about the educational journey. Each institution's teaching approach is distinct and determined solely by the institution. Register with Grandomizer to start this connection.

Grandomizer does not charge a dime, which is great news for those interested. To get started, register with Grandomizer.

Get quick access to a suitable investment tutor. Grandomizer factors in the user’s experience when assigning them an education firm. Personalized and structured learning is the goal.

By ensuring inclusivity without cultural or national bias, Grandomizer opens its services to various individuals. Grandomizer knows that investment is a worldwide phenomenon and ensures that anyone from any background can access investment education. To this end, the website supports various languages.

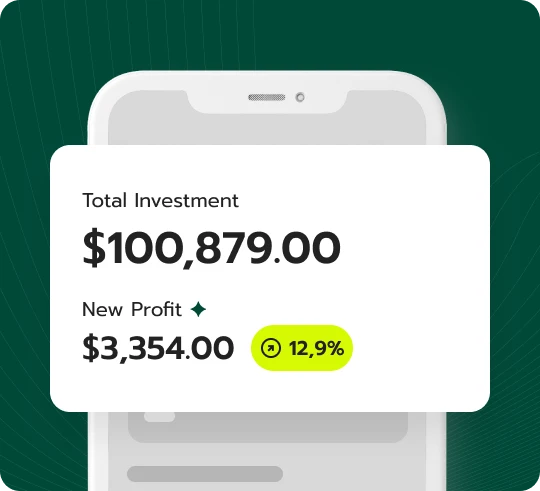

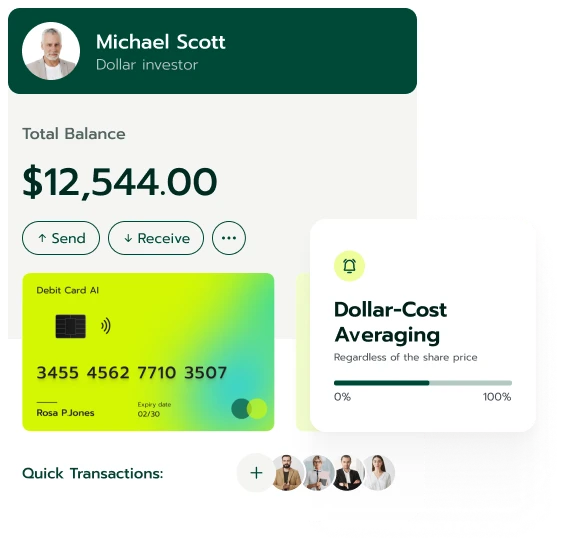

Since investments are distributed over time, those practicing this method are less preoccupied with daily market changes, fostering disciplined investment habits. To explore dollar-cost averaging further, get registered with Grandomizer.

This strategy evens out the mean cost of a share over time. This periodic investment allows one to purchase more shares when the price is lower and fewer when prices are higher, leading to buying the shares at a lower cost.

This strategy may give one the upper hand in unpredictable markets because individuals acquire more shares at a lesser price, leading to a greater turnaround if the market recovers. Understand more of this after connecting via Grandomizer.

DCA imbibes self-control in people and limits emotional reactions to the unpredictable market. The market is very volatile and unpredictable, so rational reasoning is an essential trait to develop.

It allows one to avoid the dangers associated with forecasting the market's highs and lows. Timing is an essential determinant when dealing with the market and expecting positive results. However, getting the timing right can be extremely difficult. Here’s how DCA makes do without market timing.

Consistency Over Gains

DCA isn’t about catching highs and lows. This approach attempts to reduce the risks associated with short-term volatility.

Risk Diversification

This is the spreading of resources to various asset classes. Aimed at mitigating the volatility that comes from owning just a single asset. This lowers the risk of poor timing because the unpredictability and fluctuations of the market have a reduced effect.

Gradual Investment Strategy

This systematic approach is a way to evade the dangers of market timing. A standard amount is put in, irrespective of the state of the market, which in turn may level out the impacts of market fluctuations with time.

An example is when an investor periodically puts a fixed amount into a broad market index fund every month. This person does this regardless of the state of the market. After a few years, this consistent approach might outperform other efforts to outperform the market’s highs and lows.

In dollar cost averaging, the investments put in can be automated to reduce the maintenance cost. Enhancing the total investment is an advantage gained from investing a certain amount each month. This allows for acquiring more shares when the prices are low and fewer when the prices are high. Connect with Grandomizer for more insights into dollar-cost averaging.

Volatility can stem from short-term news reactions or long-term economic trends, making it essential for investors to know how to react in these scenarios. Register with Grandomizer to learn more about this concept.

Things like the state of the economy, events happening on a global scale, or a change in the priority and interest of those in the market can affect market volatility. The comprehension of these factors helps in qualifying investment risks. Grandomizer can facilitate connections to educational firms to explore this topic further.

Grasping market volatility is crucial for informed investment choices. Education through Grandomizer can clarify the path to managing investments amid volatility. Interested? Learn more via Grandomizer.

Educational institutions connected through Grandomizer provide in-depth insights into market volatility. Register with Grandomizer to start this educational journey. Below, we explore different aspects of market volatility;

This measures past price movements to gauge market variation. Certain characteristics drive these fluctuations. Studying past price action helps spot and analyze recurring patterns and predict future behaviors of the market.

This predicts possible future fluctuations based on certain key points. These include global happenings, development in various sectors of the economy, and other factors. These anticipations assist in preparing a strategy for managing any kind of occurrence.

This is known as the "fear indicator." It calculates the expected market volatility during the upcoming 30 days. The higher the value, the greater the potential for a big price bump, while a lower value shows more steadiness.

This describes a sudden or abrupt drop in the prices of assets in a financial market. This drastic reduction happens in a few minutes or seconds. Possible causes include sudden shifts in sentiment regarding assets, market liquidity activities, or technical trading frameworks.

Value investing is based on the idea that the market does not always represent the actual value of a company. This may provide a golden chance for people to buy stocks at a discounted price. Register with Grandomizer to begin learning about value investing.

A difficulty experienced with this approach is the delay when the undervalued asset takes longer than expected or, even worse, does not live up to the anticipated returns. These unfortunate events can frustrate the purpose of even getting involved with value investing.

Significant gains may result if the market eventually acknowledges the true value of undervalued stocks. Get connected with Grandomizer to learn more about value investing principles and applications.

The investment landscape is vast and evolving. Grandomizer acts as a conduit to educational firms, equipping individuals with knowledge to navigate this terrain. Thanks to Grandomizer, people now have the opportunity to understand key investment concepts and make informed decisions. Register on Grandomizer to get started.

The margin of safety strategy involves purchasing securities at a massive discount to their intrinsic value. This may provide a fail-safe that shields one from possible market pitfalls or any unfortunate events, thereby lessening losses.

This strategy involves studying a company's financials to determine its actual worth and value rather than following market trends alone. It examines key factors such as revenue, debt level, and cash flow to understand a company's strengths and shortcomings.

Value investing often requires holding stocks for years. These stocks or assets are held in the hope that the current value measures up to the intrinsic value with time.

This is the estimated worth of an asset based on its foundational attributes, such as its position in the market, its fiscal condition, or its potential value. The aim is to identify those currently undervalued assets which may later show their true worth.

This tactic proposes that the most valuable opportunities may come when market sentiment is low. With appropriate positioning when the market is down, one may see gains if the market corrects.

In value investing, certain risks are expected. An undervalued asset may take time to realize its potential or never do so at all. Patience is a necessary virtue as the process may be slow and tedious but may yield great worth.

| 🤖 Cost of Registration | No cost involved for joining |

| 💰 Charges | Services provided without fees |

| 📋 Registration Details | Easy and fast to get started |

| 📊 Focus of Learning | Knowledge on Cryptocurrencies, Foreign Exchange, and Diverse Investments |

| 🌎 Service Availability | Offered in the majority of countries, USA excluded |